Despite this tax limitation, professional accountants can help to legally reduce taxable income by allocating costs to inventory and the cost of goods sold, which is mandated by IRC 471. Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and reduce the hassle of doing accounting. Tax practitioners should carefully weigh the potential pitfalls in advising clients with respect to the interaction of Sec. 199A and Sec. 280E until further guidance is provided. As previously discussed, Sec. 280E precludes a business that is considered to traffic in a Schedule I or II narcotic from taking a deduction or credit for anything other than costs of goods sold. As of this writing, there is no guidance with respect to the interaction between Sec. 280E and the Sec. 199A deduction. This structured overview of financial activities allows for better reporting and insight into your business’s financial health.

Our Specialized Cannabis and CBD/hemp Program Will Provide:

A well-structured COA helps businesses follow regulations and maximize tax deductions, making it easier to navigate challenges. Before saving with a taxable account, consider the order of where you should save first to accomplish your financial goals best. Are you comfortable taking responsibility in making investment decisions? Before saving in a taxable brokerage account, it’s important to consider where saving adds the most value to your unique financial situation. Security and insurance of brokerage accounts should also be considered before opening an account.

Public Services and Procurement Canada

As mentioned above, maintaining documentation is an important part of your business operations, and being able to substantiate transactions in your accounting system is important for being audit-ready. It medical marijuana accounting is essential to review all expenses incurred by the business to determine which ones can be allocated to COGs. These allocable expenses include rent, payroll, utilities, and costs allowed by IRC 471.

The Risk and Reward of a Cannabis Business COA

With this exception, your business can reduce its total tax liability, especially if your cost of goods sold is significant. This Section 280E exception could mean the best way to maximize your business profits is by assigning indirect and direct costs to inventory. In conclusion, it’s worth the effort required of cannabis-business owners https://www.bookstime.com/ to manage their accounting practices according to code. Becoming IRC 280E-compliant is the first important step in avoiding or successfully getting through an audit. An online document-storage system is a great way to file and keep track of important business documents, expenses, revenues (invoices), and accounting workpapers.

The Cannabis Industry: Cannabis Business

Other account types may add more value and/or tax-efficiency depending on a household’s financial situation. Everyone’s investment goals and preferences are unique, and not all brokerage accounts are a perfect fit. To choose the best online brokerage, start by looking at your investment style and what you want from a brokerage.

- Continue reading for a closer looks at these accounting tools to see which might benefit your business the most.

- Fidelity offers international investing in foreign markets and foreign currency exchange between 16 different currencies.

- QBO is limited when it comes to state excise and local taxes on cannabis.

- TikTok did not name the other affected accounts, other than to note that the account of socialite and reality TV star Paris Hilton was targeted but not compromised.

- In addition to offering competitive accounts with no minimum balance requirements and no recurring fees, Schwab is a leader in low-cost pricing for retail investors.

- Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and reduce the hassle of doing accounting.

In the case of cannabis, a federally controlled substance, every piece of inventory matters. However, you may still be able to find a bank that can work with your cannabis business. Any cost which (but for this subsection) could not be taken into account in computing taxable income for any taxable year shall not be treated as a cost described in this paragraph.

Best Online Brokerages of June 2024

The Cannabis Industry Accounting and Appraisal Guide – Second Edition

Hosting Server Read Timeout

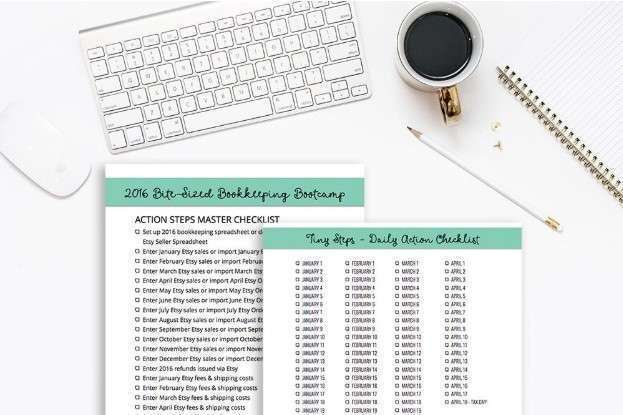

Find more like this: Bookkeeping